How Your Accountant in Roswell Helps You With Depreciation?

Have you bought new business assets? Your new small business assets begin to depreciate after you make a purchase. According to tax regulations, certain business assets are required to be expensed on a depreciation basis. Your accountant in Roswell is ready to support you in your business making decisions.

Depreciation Formula

Your small business assets can be expensed using straight-line depreciation. Due to being classified as tangible, cars, trucks, and equipment tend to depreciate after making a purchase. Straight-line depreciation doesn’t always fully represent real-world depreciation of your assets, but it can provide a general idea of how much is depreciating.

Making sure depreciation is fully expensed in the straight line method requires existing knowledge of your asset’s initial value, salvage value, and useful life. Taking that into account, the first step is to subtract the salvage value from the initial value. Next, the result from the previous step is divided by the useful life in years.

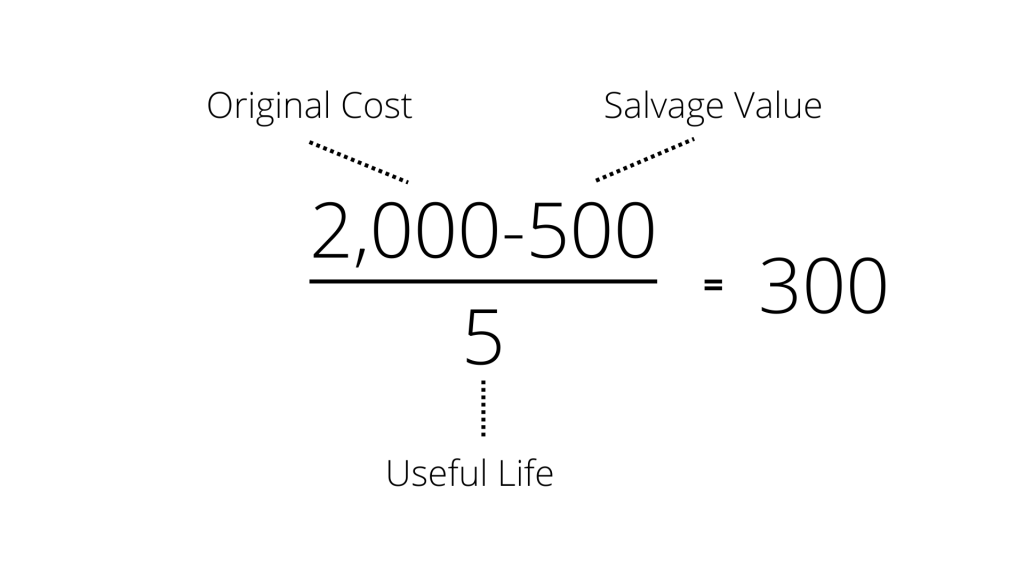

Real-World Example

Using the straight-line method here’s an example based on an asset with an initial value of $2,000, salvage value of $500, and useful life of five years:

Bookkeeping

Depreciation of a business asset has implications for your small business bookkeeping and preparation for year-end tax filing. First, a schedule should be put in place to determine the depreciation over the useful life of the business asset. Significant expenses from purchasing assets worth tens or hundreds of thousands of dollars don’t apply to daily operations and are therefore expenses according to the depreciation schedule. With your accountant in Roswell, the process is done to ensure the best results and verify the accuracy of your company’s books.

Assets with High Values

When figuring out your depreciation expenses, there are certain things to be aware of with high-value assets. First of all, depending on the type of asset, it may depreciate quickly or increase the rate of depreciation over time. Be aware that depreciation calculations may need to be adjusted accordingly to market conditions. Your accountant in Roswell uses cutting-edge software and financial expertise to ensure that your business receives the best deduction for your tax situation. Improved real-world values of certain assets such as cars, trucks, and heavy machinery may be calculated using accelerated depreciation.

What about the Form 179?

If you’ve made a recent purchase for your small business, you may be interested in what applies to Form 179. From the IRS website, the maximum allowable expense on an asset to be deducted fully using Form 179 has been raised from $500,000 to $1,000,000. Common assets in this range include office technology such as workstations, multi-function printers, vehicles with a gross vehicle weight (GVW) of at least 6,000 lbs or 3 tons, and other business-related machines. We recommend that you speak with your accountant in Roswell for clarification and implications in your business and industry.

Wrap Up

Don’t be too concerned if you are still unsure about depreciation and how it applies to your business assets. Your accountant in Roswell can help you through the process and verify tax compliance with the regulations related to your business filing and business type. Feel free to ask questions and learn during your meeting, as this will reduce confusion later down the road with tax season. We recommend that you double-check with your accountant after making any depreciation calculations and verify that the numbers match up with the correct amounts and periods.